Better Quantum Computing Stock: Microsoft vs. IonQ | The Motley Fool

These firms build technology that can revolutionize the computer industry.

Quantum computers promise to revolutionize computing as we know it, making it a promising industry to invest in. Alphabet-with Google’s quantum computer completed a complex calculation in six seconds that would have taken 47 years on a supercomputer.

This shows the quantum potential, a term that describes how much more efficient quantum machines can be than today’s computers. Quantum computing uses subatomic particles, called qubits, to perform many calculations simultaneously, speeding up the sequential processing of a traditional computer. But while Google’s display was impressive, these machines are far from everyday use.

However, many companies are racing to do so. The two most prominent are the old ones Microsoft (MSFT 1.06%) and young IonQ (IONQ 2.10%). The former is a tech colossus, but the latter benefits from focusing solely on quantum computing.

In this comparison between David and Goliath, which is the better investment in the nascent quantum computing field? Let’s look at each company to find the answer.

Microsoft’s approach to quantum computing

Microsoft began working on quantum computers in the late 1990s, trying to create quantum systems that could scale with reliability. This reliability is important because qubits are inherently unstable. Any external influence, such as an increase in temperature, can damage the qubit, causing errors in calculations.

The company has spent decades trying to overcome this problem. Today, the conglomerate combines several components to provide a reliable quantum system. It combines its Azure cloud computing platform, software it has developed for quantum computing, and quantum hardware from partners such as Quantinuum and Atom Computing.

Earlier this year, Microsoft combined its software with Quantinuum hardware to improve error rates by 800 times. In September, Microsoft and Atom Computing collaborated to build “the world’s most powerful quantum machine, ” according to the companies.

Microsoft does not disclose quantum computing-related revenue. In its 2024 fiscal year, which ended June 30, the conglomerate’s quantum computing business fell short of its research and development efforts, suggesting that the technology’s revenue contribution , if it exists, is of no use to Microsoft’s business at this time.

This makes sense. In addition, Microsoft’s bread and butter is its Azure, Windows, and Office products, which helped it reach $245.1 billion during its fiscal year 2024, a 16% year-on-year increase.

IonQ advances in quantum computing

Compared to Microsoft, IonQ’s quantum computing history is short, the company was founded in 2015. However, its quantum offerings are generating rapidly increasing revenue.

IonQ achieved $11.4 million in sales in the second quarter, a 106% year-over-year increase. For the full year, IonQ estimates it will reach at least $38 million in revenue, up 73% from 2023’s $22 million.

The company is growing revenue successfully because its quantum computing technology has attracted customers such as Oak Ridge National Laboratory, which uses IonQ technology to improve the US power grid, and Hyundaiwhich is developing self-driving cars with IonQ quantum computers. The firm has even partnered with Microsoft, making its quantum devices available through Microsoft’s Azure platform.

In its quest for more benefits, IonQ technology uses ions for its qubits. This, along with its unique equipment, has helped the firm achieve 99.9% accuracy in its qubits.

In an effort to boost accuracy even more, IonQ has switched to using ions from the element barium instead of ytterbium, an industry first to do so. This change will be integrated into its hardware starting next year.

Deciding between Microsoft and IonQ stock

In terms of technology, IonQ appears to have produced better quantum computing results than Microsoft, as evidenced by revenue growth and technical achievements. However, the company is not profitable. In Q2, IonQ lost $37.6 million.

Meanwhile, Microsoft is growing profits. In its fourth fiscal quarter, ended June 30, the company generated revenue of $ 22 billion, an increase of 10% year over year. It’s just one more reason to prefer Microsoft over IonQ.

One is financial risk. IonQ’s lack of profitability means that if it can’t maintain its strong rate of revenue growth, it could suffer financial problems, while Microsoft offers a stable business.

Furthermore, industry estimates show that the current phase of quantum computing, where the technology is still developing, will last until at least 2030. That’s when it is estimated that the benefits of quantum computing will begin to scale away from traditional computers. For many years before that happens, it is not known who will succeed.

Also, Microsoft pays dividends, which the conglomerate increased 10% in September to $ 0.83 per share. IonQ does not make a profit.

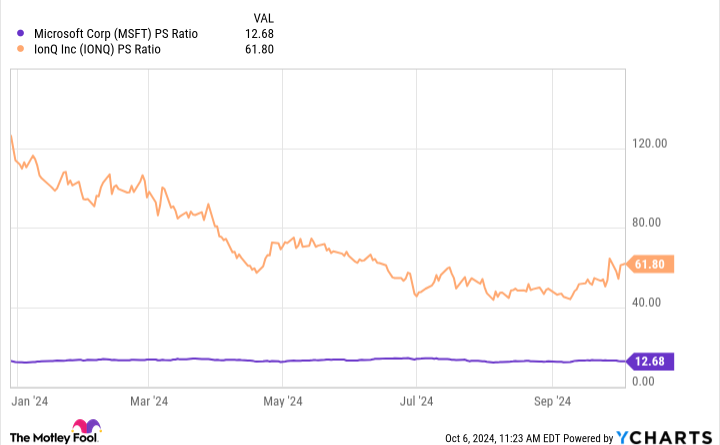

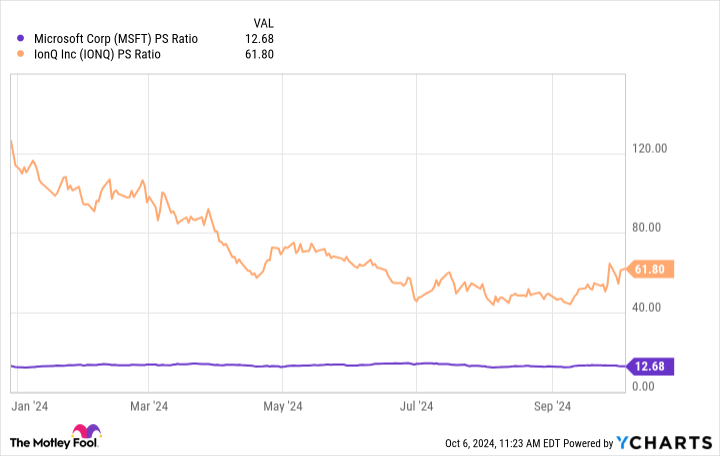

Moreover, from a stock value perspective, Microsoft is the best choice. Because IonQ is not profitable, let’s look at the price-to-sales ratio (P/S ratio), which reveals how much an investor has to pay for a share of the stock relative to its capital.

Details on YCharts.

IonQ’s P/S ratio is down from earlier in the year, but compared to Microsoft, it’s still expensive. Therefore, Microsoft’s lower P/S makes it a better value.

Since the quantum computing industry may never achieve mass benefits, Microsoft is a better investment in computing, and while you wait to see how the industry shakes out, you can collect income.

#Quantum #Computing #Stock #Microsoft #IonQ #Motley #Fool